Since March 2020, Revenue has suspended debt collection and the charging of interest on late payment for the January/February, March/April and May /June VAT periods and February, March, April, May and June PAYE (Employer) liabilities. In May 2020 Revenue announced the warehousing of these tax debts.

On 23 July 2020 as part of the Business and Community Stimulus package, the Government announced a reduced interest rate of circa. 3% per annum on non-COVID-19 related tax debts designed to provide vital liquidity support to struggling businesses and sole traders that have historic unpaid tax debts.

Taxpayers who enter into an agreement with Revenue no later than 30 September 2020 can avail of the reduced rate from the date of that agreement.

What is warehousing of tax debt?

Revenue has suspended debt collection for VAT and Employer PAYE liabilities incurred by businesses during the period when their trade was restricted – either stopped completely or significantly reduced – by the impact of COVID-19. Interest will not be charged on this debt during the “COVID-19 Restricted Trading Period” or during the following 12 months. After that, interest will be charged at c. 3% per annum on the “warehoused” tax debt until it is paid. This contrasts with a rate of c. 10% per annum normally charged on such liabilities.

The Scheme is being largely welcomed by taxpayers who have been impacted by COVID-19, as the provisions of this scheme provides a source of liquidity for businesses as they emerge from the COVID-19 restrictions which have impacted their businesses.

Qualifying Businesses

Firms that qualify for the wage subsidy are also likely to qualify for deferment of these liabilities. These are Firms with sales or orders down 25%.

Revenue are expected to be flexible in their approach in dealing with taxpayers.

Based on Revenue guidance the scheme will generally operate as follows:

- It applies to all effected SMEs.

- Larger firms impacted by C-19 and experiencing tax payment difficulties should apply to the Collector General, or their LCD or MED branch contact.

Where not an SME, there is a need to engage with Revenue.

Suspension of Debt Collection and Charging Interest

Since 1 March 2020, Revenue had on a concessional basis suspended debt collection and the charging of interest for the late payments of the January/February and March/April VAT periods as well as February, March and April PREM (Employer) liabilities. This concession applied automatically for SMEs with medium and larger businesses being in a position to request similar treatment where they were able to satisfy Revenue that they were experiencing temporary cash flow or trading difficulties. So far these deferred payments have amounted to over €1,260 million. These measures are extended to include the May/June VAT period and May and June PAYE (Employer) liabilities.

Debt Warehousing Scheme

The Debt Warehousing Scheme (the “Scheme”) is intended to formalise the informal arrangements which had been granted. Pursuant to the Scheme, VAT and PAYE arising during the period in which the business was and is unable to trade, or was and is trading at a significantly reduced level will in effect be deferred for repayment at a later date. The two most beneficial aspects of this Scheme for taxpayers are:

- Any VAT and PREM (Employer payroll deductions) taxes arising in the restricted trading period will be warehoused for 12 months during which there will be no collection of this debt by Revenue and no interest will be charged; and

- Following this 12 month period, businesses will benefit greatly from a significantly reduced interest rate of 3% which will apply on the repayment of the warehoused tax debt until it is fully paid. This compares to a rate of 10% per annum currently charged on overdue VAT and PAYE (Employer) tax debts.

Revenue would normally work closely with businesses to put in place arrangements appropriate to the circumstances and viability of each business in order to secure payment of any debt over a reasonable timeframe. However, Revenue recognises that, in the current circumstances, businesses that have had to close or have been significantly negatively impacted by the restrictions may not be able to enter into arrangements in the short term to clear any COVID-19 related tax debt. In addition to this tax debt, businesses face the challenge of paying their ongoing tax liabilities as they arise after they reopen; pay their trade and other non-Revenue creditors; complete any necessary restructuring to deal with new trading arrangements in the context of social distancing; build up stock, etc.

In response to these business challenges, the Government has legislated to allow for debt associated with the COVID-19 crisis to be deferred or ‘warehoused’. The scheme allows for the deferral of unpaid VAT and PAYE (Employers) debts arising from the COVID-19 crisis for a period of 12 months after a business resumes trading (in accordance with the Reopening Roadmap) and the application of a lower interest rate of 3% per annum on the repayment of such warehoused tax debts after that date. PAYE (Employer) liabilities include income tax, USC, employer’s PRSI and LPT collected by the employer on behalf of a customer which are due to be remitted by employers under the PAYE system. This scheme will be administered by Revenue.

The period covered by the scheme is the time during which the business was and is unable to trade due to the COVID-19 related restrictions and includes two months after the business re-commences trading.

Under the Scheme, VAT and PAYE (Employer) tax debts deferred while a business is unable to trade or was subject to restricted trading due to the COVID-19 related health restrictions, as well as debts for an additional two months after the business resumes “normal” trading, will be ring-fenced by Revenue.

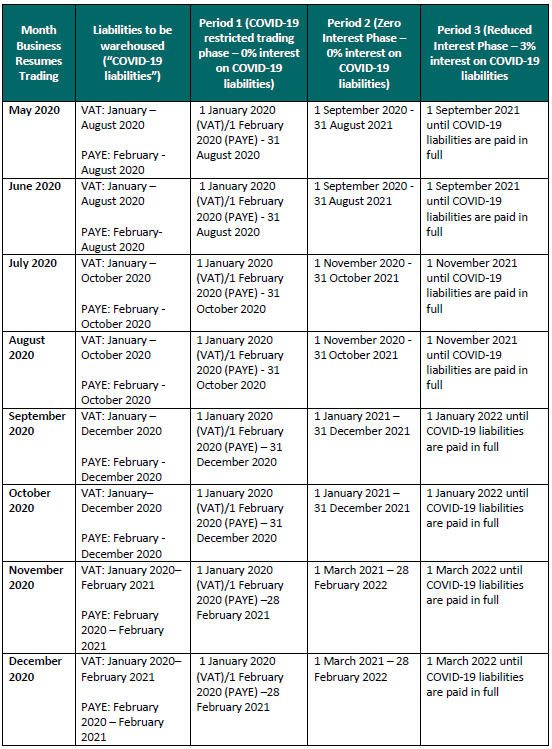

The scheme will have three periods, namely:

(A) PERIOD 1: COVID-19 RESTRICTED TRADING

- This first period will operate while businesses are unable to trade or are trading at a significantly reduced level and for two months after normal trading resumes. During this time for SMEs there will be no collection of any of VAT and PREM (Employer payroll taxes) arising in the period and no interest will apply. However the relevant tax returns must still be filed during this time. If a tax return has been filed on a best estimate basis, the correct return must be filed before the end of Period 1 to ensure the debt benefits from the warehousing. Whilst the scheme applies automatically to SMEs, medium and large businesses that are “severely impacted by COVID-19” can request to access the scheme.

- It is important to note that Period 1 may vary from sector to sector and business to business, given the Government’s phased road-map to unlocking COVID-19 restrictions.

(b) PERIOD 2: ZERO INTEREST PHASE

During this period no interest will be charged on the debt built up in Period 1 but current tax liabilities must be discharged as they arise..

This period related to the resumption of “normal” trading, the outstanding VAT and PAYE (Employer) tax debts will be warehoused for 12 months during which there will be no collection of this debt by Revenue and no interest will be charged. However, businesses will be expected to pay current liabilities as they arise during this 12-month period.

(C) PERIOD 3: REDUCED INTEREST PHASE

At the end of the “warehoused” 12-month period, a reduced interest rate of 3% will apply on the repayment of such warehoused tax debt until it is fully paid.

This will last from the end of Period 2 until the COVID-19 related debts built up in Period 1 are paid. A reduced interest rate of 3% will apply on the repayment of the debt from Period 1.

Liabilities available for warehousing

How can tax debt be warehoused?

Access to the warehouse arrangement is automatic for all businesses managed by Revenue’s Business Division (turnover <€3m) and Personal Division. Access is available on request for businesses managed by Revenue’s Large Corporates Division (LCD) and Medium Enterprise Division (MED).

What type of tax debt can be warehoused?

The warehousing scheme applies to VAT and PAYE (Employer) debts only. PAYE (Employer) liabilities include Income Tax, Universal Social Charge, employees’ and employer’s PRSI and Local Property Tax due to be remitted by employers under the PAYE system.

What is the start date for warehoused debt?

The periods currently covered by the warehousing arrangement include:

- VAT for January/February, March/April and May/June 2020 periods

- PAYE (Employer) liabilities for February, March, April, May and June 2020

- and the first two months of a complete VAT period after resumption of trading.

How do I contact Revenue to arrange for tax debt to be warehoused?

Small and Medium Enterprises

Revenue has already commenced “warehousing” the debt for customers dealt with in Revenue’s Business Division and Personal Division and will shortly contact these customers to confirm they are covered by the scheme.

Other businesses (turnover above €3m)

For other cases, entry to the scheme is by application either to

- the Revenue Branch normally dealing with the business’s tax affairs (in Revenue’s Medium Enterprise Division or Large Corporates Division as appropriate) or

- the Collector General’s Division.